New Beneficial Ownership Information Reporting Requirement Is In Effect

February 26, 2024

The Corporate Transparency Act (CTA), now requires every domestic and foreign entity that is a corporation, LLC, or that is formed by filing a document with the Secretary of State (trusts and partnerships) to disclose "Beneficial Ownership Information" (BOI) for at least one beneficial owner.

- Beneficial owners:

- own at least 25% of stock, equity, profits

OR

- exercise substantial control over the reporting entity (such as non-owner senior officers including President and CEO) - • Beneficial Owners must report:

- Full Name

- Date of Birth

- Address (not the Company address

- PDF or JPEG of unexpired license or passport

New entities created after December 31, 2023, must file within 90 days of creation, while existing entities before January 1, 2024, must file by January 1, 2025.

The BOI report must be submitted electronically to FinCen and includes stringent penalties for willful non-compliance. Specific exemptions apply to entities such as publicly-traded companies, banks and credit unions, securities brokers and dealers, public accounting firms, and tax-exempt entities. “Large operating entities” that employ more than 20 people in the U.S., have reported gross revenue of over $5 million on the prior year’s tax return, and are physically present in the U.S are also exempt.

For comprehensive information and compliance, businesses can refer to FinCen's website at www.fincen.gov/boi.

IRS Changes to Login Procedures for IRS.gov become MANDATORY June 15th, 2023

May 3, 2023

Per FS-2021-15, released November 17, 2021 -The Internal Revenue Service has updated how users sign in and verify their identity for certain IRS online services with a mobile-friendly platform that relies on trusted third parties and provides an improved user experience.

The IRS is using ID.me, a trusted technology provider of identity verification and sign-in services, for taxpayers to securely access IRS tools. Anyone with an existing ID.me account from the Child Tax Credit Update Portal, or from another government agency, can sign in with their existing credentials. If they're a new user, they'll have to provide a photo of an identity document such as a driver's license, state ID or passport as part of the identity verification process. They'll also need to take a selfie with a smartphone or a computer with a webcam. Once they verify their identity, they can use their account across multiple IRS tools and at other government agencies that also use ID.me.

On June 15th, the ID.me verification process will become mandatory. It is up to users to complete the verification process before the deadline to ensure they can pay their estimated tax payments in time. In response to some backlash regarding the facial recognition software, users will also have the option to video chat with a “trusted referee” to verify their identity. Additionally, once the verification process has been completed, ID.me deletes all biometric data. Once this is one time process is completed, users will then use their login credentials to sign onto the platform. Multi-factor authentication will also be required to login.

New York State Retirement Program Enrollment Requirements for Private Employers

November 19, 2021

Last month, New York Governor Kathy Hochul signed a new law requiring private employers that meet certain criteria to automatically enroll their employees in the State’s Secure Choice Savings Program, a retirement plan overseen by the State for private sector and nonprofit employees similar to an IRA, if the employer does not offer its own qualified retirement plan.

The new law applies to employers who:

- have employed at least 10 employees in the State, at all times, in the previous calendar year.

- have been in business in the State for at least 2 years.

- do not already offer qualified retirement options, such as a 401(a), 401(k), 403(a), 403(b), 408(k), 408(p), or 457(b) plan, as listed in the statute, or other pension benefit plan, in the preceding 2 years. Employers already offering such plans may not terminate those plans to participate in the Secure Choice program.

Key points:

- Employees shall initially be enrolled at a contribution rate of three percent of their wages (though they may voluntarily elect to modify their contribution level)

- Payroll deductions for such contributions shall not begin until after the 30th day after an employee has been enrolled in the program.

- Employers are not required to contribute to the program.

- Employees who opt out will need to wait for an annual open enrollment to opt back in if they so choose

The law took effect immediately upon signing on October 21, 2021, though employers will have time to establish their participation in the program once it is launched. We will continue to monitor and report on further developments as this program is implemented.

NEW YORK STATE PASS-THROUGH ENTITY TAX

August 25, 2021

New York State enacted a new pass-through entity tax for tax years beginning on or after January 1, 2021. Any pass-through entities including a limited liability treated as a partnership for federal purposes and any New York S Corporations are eligible to make an irrevocable election annually to pay the pass-through entity tax by the first estimated payment due date, March 15 for calendar year entities. For 2021 only, the election is due by October 15. Electing entities are required to make four equal estimated payments for a total of the lesser of 90% of the current-year tax or 100% of the prior year tax.

A tax credit is available for direct partners or shareholders and the credit is equal to the partners’ share of the PTE tax paid. Individuals claiming a tax credit for the PTE tax paid must add back the amount of the PTE deduction for NYS.

Beginning in 2021, New York residents can claim credit for entity-level taxes paid to other states that are ‘substantially similar’ to the New York PTET on account of income derived from such other states and subject to tax under Article 22. While New York has enacted a credit for New York residents for tax paid to other states, other states may not provide such a credit. Consideration for residency of owners is a necessity.

EMPLOYEE RETENTION CREDIT

January 25, 2021

If you received PPP loan proceeds or are applying for the second round of PPP loans, you may still qualify for the Employee Retention Credit!

WHAT YOU NEED TO KNOW

- Under the CARES Act, companies that received the Paycheck Protection Program (PPP) loans could not claim the Employee Retention Credit (ERC).

- On December 27th, Congress signed into law the second Coronavirus relief package, which included a provision to allow companies who claimed PPP funds to also claim the ERC.

WHATS THE CATCH?

- No double dipping - ERC cannot be claimed for wages paid with PPP loan proceeds that have been forgiven.

- The change is retroactive for wages paid after 3/12/20 - any wages paid in excess of wages paid using PPP loan proceeds are eligible for the ERC.

- For the final 3 quarters of 2020, companies are eligible for the ERC if in any quarter their gross receipts were less than 50% of their gross receipts in the same quarter in 2019 OR their operations were fully/partially suspended by government order related to COVID-19.

- The same is true for the first two quarters of 2021, with two exceptions:

1) ERC can be claimed if gross receipts were less than 80% of gross receipts for the same quarter in the prior year.

2) ERC may also be claimed if gross receipts for the prior quarter were less than 80% of gross receipts compared to the corresponding quarter in 2019. - ERC is available for wages paid 3/12/20 - 6/30/21.

For 2020 - ERC is equal to 50% of qualified wages (capped at $5000 per employee)

For 2021 - ERC is equal to 70% of qualified wages (capped at $7000 per employee PER quarter)

In total, companies could receive as much as $19,000 per employee for 2020 & 2021.

IRS Denies Deductibility of PPP-Funded Expenses

November 24, 2020

On 11/08/20, the IRS issued Revenue Ruling 2020-27 and Revenue Procedure 2020-51, clarifying their previous position as stated in the IRS Notice 2020-32, regarding the deductibility of expenses paid with Paycheck Protection Program (PPP) funds. IRS Notice 2020-32 states, “no deduction is allowed for an eligible expense that is otherwise deductible if the payment of the eligible expense results in forgiveness of the covered (PPP) loan.” What this essentially means is that although the PPP funds should not be considered taxable income if the loan is forgiven, the qualified expenses paid using those funds should also not be deductible for income tax purposes.

The American Institute of CPAs believes that the IRS’s interpretation denying deductions of expenses forgiven under the PPP is contrary to Congress’s intent when creating the PPP loans, and is continuing to advocate for legislation that would clarify that the receipt and forgiveness of assistance through the PPP does not affect the deductibility of ordinary business expenses. As of the date of this writing, Congress has not signed anything into law that counters the IRS guidance issued.

New York State Enacts Sick Leave Law

September 24, 2020

The New York State Budget Bill signed into law by Governor Cuomo on April 3, 2020 amends the New York State Labor Law to require all employers, regardless of size, to provide annual sick leave to their employees.

Current employees will begin accruing leave Sept 30,2020 and may start taking sick leave as of January 1, 2021. Employers should begin implementing policies and procedures to comply with the law. Employers who intend to rely on an existing sick leave or paid time off policy should review their current policy to ensure it meets all of the requirements of the new law.

- This Law applies to all private employers (and all employees) in New York State, but the level of required leave depends on an employer’s size and net income. Employers with four or fewer employees and a net income of $1 million or less in the previous tax year will only have to provide unpaid sick time. All other employers will be required to provide up to 40 hours of paid sick leave each calendar year, with employers of 100 or more employees providing up to 56 hours of paid leave. Accrued/unused sick time must carry over to the next calendar year. If an employer’s existing sick leave or time-off policies meet the minimum requirements (including accrual, carryover, and use) of the Law, no additional sick leave needs to be provided.

What New York Employers Should Do Now:

- Employers that already provide employees with paid sick leave benefits that meet or exceed the Law’s requirements need not change their current policy, as long as the policy meets all of the Law’s mandates on uses, accrual, and carryover. The Law requires employees to accrue sick leave at a rate of at least one hour for every 30 hours worked.

- Employers that do not currently have a paid sick leave policy or have one that falls short of the Law’s statutory requirements should begin to develop a compliant policy that will be ready to implement by September 30, 2020, which is the date that employees begin to accrue sick leave benefits.

- Employers may choose to frontload sick leave by providing the total amount of sick leave at the beginning of the calendar year.

For more detailed information on how the law may affect your business, give us a call to discuss your situation or visit https://paidfamilyleave.ny.gov/COVID19 or https://www.nysenate.gov/legislation/laws/LAB/196-B

The Coronavirus Aid, Relief, and Economic Security Act (CARES)

April 1, 2020

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) was signed into law after the legislation was passed with bipartisan support in the U.S. Senate and House of Representatives. The CARES Act includes substantial relief and stimulus benefits for individuals and businesses impacted by the Coronavirus (“COVID-19”) crisis. We have comprised a summary of a few key changes made by the Act. Please use the links included below or contact our office for more information.

Individual Recovery Rebates (Stimulus Checks)

Please note – at the time of this writing, no new information has been released by the IRS regarding these. See: https://www.irs.gov/coronavirus for updates

SBA Payroll Protection Program Loans

Meant to help small business keep workers employed amid the pandemic, these loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward. The amount of the loan is 2.5 times the average monthly payroll up to $10 million. These loans do not require collateral or guarantees. The loan may be used for payroll costs; continuation of group health care benefits, insurance premiums, interest on mortgage obligations, rent, utilities, and interest on other outstanding debt. A borrower is eligible for loan forgiveness equal to the amount the borrower spent on the following items during the 8-week period beginning on the date of the origination of the loan: payroll, interest on mortgage obligations, rent on a leasing agreement, and payments on utilities (electricity, gas, water, transportation, telephone, or internet). For borrowers with tipped employees, additional wages paid to those employees will also be forgiven.

More details (including a list of lenders offering these loans) will be released soon. For more detailed information on who is eligible and how to prepare to apply go to: https://www.uschamber.com/sites/default/files/023595_comm_corona_virus_smallbiz_loan_final.pdf

SBA Economic Injury Disaster Loans

In response to the Coronavirus (COVID-19) pandemic, small business owners are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million. The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid (even if the loan is subsequently denied). However, the remainder of the loans are not forgivable and will need to be repaid at an interest rate of 3.75% for businesses and 2.75% for non-profits. These loans can be used to meet ordinary and necessary financial obligations (operating expenses, payroll, rent, fixed debts, higher interest rate debts).

The Express Bridge Loan Pilot Program is also available and allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork while waiting on a decision regarding their Economic Injury Disaster Loan.

For more detailed information on who is eligible and how to apply go to: https://covid19relief.sba.gov/#

Please note that businesses cannot get both EIDL and PPP loans at the same time. You can apply for the EIDL loan now and the PPP loan when it becomes available. If you qualify and accept the EIDL loan, and you subsequently qualify for the PPP loan, you can re-finance the EIDL loan with the PPP loan, OR you can apply for both loans and decide which one you take if you qualify for both. Loans are limited to one per Taxpayer Identification Number.

TAX ORGANIZERS

January 20, 2020

We have mailed out the 2019 income tax organizers to individual clients. We believe the tax organizer will not only assist you in organizing your records, but it will also assist us in streamlining the flow of tax returns in our office and will allow for better follow up questions and quicker turn-around time for completed returns.

As always, we are available for any questions you may have about the organizer and information you have received from third parties that may or may not be applicable to your tax return.

It is essential that you submit all of your tax information to us BEFORE APRIL 1, 2020. If information is received after this date, we may have to file an extension and additional fees may be imposed.

2020 TAX CHANGES

January 16, 2020

A series of changes that could affect many taxpayers were signed into law by Congress on December 20, 2019 with the SECURE Act. There are 4 important changes that affect taxpayers who save for retirement. The changes we would like to address pertain to 2020 and going forward primarily, but it should be noted that many of the changes made in the full SECURE Act are retroactive to as early as 2017.

Change #1: There is no longer a maximum age for making traditional IRA contributions.

Before this repeal, traditional IRA contributions were only allowed up until you reached age 70½. Starting in 2020, contributions to a traditional IRA can be made at any age, as long as the participant has compensation of some kind such as wages or self-employment income. The Act also coordinates this change with a new rule for qualified charitable distributions (QCD). Before the Act, you could make qualified charitable contributions of up to $100,000 per year directly from your IRA(s). However, for tax years beginning after 2019, the $100,000 QCD limit for that year is reduced (but not below zero) by the aggregate amount of deductible IRA contributions made for the year you reach age 70 1/2 and later. This is an important change to estate planning.

Change #2: The required minimum distribution (RMD) age was raised from 70½ to 72.

Before 2020, retirement plan participants and IRA owners were generally required to begin taking RMDs from their plans by April 1 of the year following the year they reached age 70½. Failure to make a required minimum distribution triggers a 50-percent excise tax, payable by the individual or the individual's beneficiary. The Secure Act has increased the age after which you must begin taking RMDs from age 70 ½ to 72. However, this only applies to individuals who reach age 70 ½ after 2019. If an individual has reached age 70 ½ before 2019, they are still required to take RMDs. If you are still employed at age 72 (and don’t own more than 5% of your employer), you can still postpone taking RMDs from your employer’s plan until after you’ve retired. This rule is unaffected by the Act.

Change #3: Some beneficiaries of IRAs may no longer stretch IRAs over their life expectancy.

Before the SECURE Act, if a plan participant or IRA owner died before 2020, their beneficiaries were generally allowed defer taxation of the plan or IRA distributions over the beneficiary’s life expectancy. This is often referred to as a “stretch IRA.” However, for most IRA owners or plan participants beginning in 2020 beneficiaries are generally required to distribute the entire balance of the plan or IRA within 10 years following the death of the plan participant or IRA owner. There are some exceptions to this 10-year rule though making it possible for some beneficiaries to still distribute the balance over their life expectancy. The following beneficiaries may still take distributions over their life expectancies: a surviving spouse of a plan participant or IRA owner; a child of a plan participant or IRA owner who hasn’t reached the age of majority; a chronically ill individual; and any other individual who isn’t more than 10 years younger than a plan participant or IRA owner.

Change #4: Withdrawals from retirement plans for birth or adoption expenses are now penalty-free.

The SECURE Act created a new rule starting in 2020 whereby plan distributions (up to $5,000) that are used to pay for expenses related to the birth or adoption of a child are penalty-free. Normally, distributions taken before the age of 59 ½ are generally subject to a 10% early withdrawal penalty, on top of being included in income. This new rule eliminates the penalty for early withdrawal up to $5,000. It should be noted that the $5,000 applies on an individual basis, so each spouse would be allowed to take a penalty-free withdrawal up to $5,000 for qualified birth or adoption expenses.

Although these aren’t the only SECURE Act changes that will affect taxpayers, we believe these are the most prevalent and important to note regarding retirement plans. Please contact our office with any questions you may have.

SEXUAL HARASSMENT

October 5, 2018

Beginning October 9, 2018, all New York State employers must have adopted and distributed a written sexual harassment policy. The state has provided a model policy that can be adopted by employers. Should an employer choose not to use the model policy, the state has provided a minimum standards checklist to ensure the employer's policy meets or exceeds the minimum requirements. In addition, the state has provided a model complaint form and encourages employees to use the form when making a harassment complaint. The final guidance also includes a model training program and related documents, which can be accessed here.

NEW SALES TAX RULING MAY HAVE IMPLICATIONS FOR YOUR BUSINESS

August 23, 2018

On June 21, 2018, the Supreme Court of the United States issued its opinion on South Dakota v. Wayfair, Inc., which overturned previous decisions made regarding collection and payment of sales tax from out-of-state retailers.

In the case of National Bellas Hess v. Department of Revenue of Illinois (1967), the Supreme court established the bright line rule that a taxpayer could not be required to collect sales/use tax unless that taxpayer had a physical presence (warehouse, employees, retail location, etc.) in that state. The Supreme Court upheld this ruling in Quill Corporation v. North Dakota (1992).

Since the Quill decision in 1992, drastic changes in how business is transacted have occurred. Online retail (e-commerce) is now a major component of all sales. The South Dakota v. Wayfair, Inc. case came about as part of a movement by states to modernize the previous rulings. The Wayfair case examines the constitutionality of a South Dakota law that imposes sales tax collection and remittance requirements on out-of-state sellers delivering more than $100,000 of goods or services into South Dakota or engaging in 200 or more separate transactions for the delivery of goods or services into South Dakota.

In the opinion, the court held that the physical presence rule in Quill has created an unfair marketplace that favors remote sellers. The court found that a seller meeting the volume and dollar amount thresholds within the South Dakota law would “have clearly availed itself of the privilege of carrying on a business” in South Dakota and therefore would have substantial nexus.

This ruling currently only applies to South Dakota. However, many states are now reviewing the enacted sales tax laws in light of this court decision and proposing revisions to be in line with the ruling.

We strongly encourage our retail clients to monitor their sales activity by state for potential risks. The South Dakota thresholds (more than $100,000 of good or services and/or 200 or more separate transactions) can be used as an initial benchmark for quantifying risk. Please feel free to call us with any questions or concerns.

The links below provide more information about the case:

https://www.supremecourt.gov/opinions/17pdf/17-494_j4el.pdf

https://www.accountingtoday.com/opinion/supreme-court-abandons-physical-presence-standard-in-south-dakota-v-wayfair

HIGHLIGHTS OF THE 2018 TAX CUTS AND JOBS ACT

January 1, 2018

Generally, the provisions of the Tax Cuts and Jobs Act take effect January 1, 2018. Most of the provisions affecting individuals are temporary and will sunset after 2025; the majority of the business provisions are permanent. The key changes that will affect most of our clients are highlighted below:

Individual Tax Changes

- There are still seven individual tax brackets but for 2018-2025, the rates are lowered to 10%, 12%, 22%, 24%, 32%, 35%, and 37% (indexed for inflation by a chained CPI). Look for withholding guidance from the IRS in January. In the meantime, employers and payroll service providers should continue to use the existing 2017 withholding tables and systems.

- The Standard Deduction is nearly doubled to $12,000 for single filers and $24,000 for joint filers. The additional standard deduction for the elderly and blind are retained.

- Personal exemptions are eliminated.

- The following itemized deductions have been modified or repealed:

a) For 2018 & 2019, the threshold for deducting medical expenses is reduced from 10% to 7.5% of AGI.

b) The state and local tax deduction is limited to $10,000 annually for any combination of state and local property taxes, state and local income taxes, and/or state and local sales tax. The law also prohibits pre-payment of future year taxes (unless assessed in the current year).

c) Mortgage interest deductions are grandfathered in for existing debt incurred prior to December 15, 2017. The new law limits the mortgage interest deduction to interest paid on the first $750,000 of acquisition debt. The deduction for interest paid on home equity loans is deductible as long as the loan or line of credit is used to buy, build or substantially improve a home.

d) All itemized deductions subject to the threshold of 2% AGI, including but not limited to unreimbursed employee expenses, union dues, investment management fees, certain legal fees, etc., are eliminated.

e) The deduction for casualty and theft losses is eliminated but preserved, with certain modifications, for losses incurred in federal disaster areas. - The alternative minimum tax (AMT) exemption increases from $54,300 to $70,300 for single filers and from $84,500 to $109,400 for joint filers.

- The list of qualifying expenses for Section 529 plans is expanded to include up to $10,000 in tuition at private and religious K-12 schools. Home schooling expenses are also considered qualifying expenses.

- The rule permitting taxpayers to recharacterize a Roth IRA back into a traditional IRA after a conversion is repealed.

- The Child Tax Credit increases from $1,000 to $2,000 per child and is refundable up to $1,400. The law also increases the income phase-out limitations and allows a $500 nonrefundable credit for non-child dependents.

- The law does not repeal the Affordable Care Act but does repeal the individual mandate requirement starting in 2019.

- For divorce decrees entered into or revised after December 31, 2018, alimony is no longer tax deductible to the payer and the associated income is no longer taxable to the recipient.

Business Tax Changes

- The Corporate tax rate structure is now changed to a flat 21% rate. The corporate AMT is completely repealed.

- Pass-through entities (S Corps, partnerships, LLCs, and sole proprietors) can claim a 20% deduction on earnings, subject to special rule restrictions. The deduction is not available to higher-income personal service providers.

- The new law doubles the maximum Section 179 allowance from $500,000 to $1,000,000. It also increases the phase-out threshold for Section 179 deductions from $2,000,000 to $2,500,000.

- The Domestic Production Activities Deduction is repealed.

- The cap on the depreciation deduction allowed under the “luxury car” rules for passenger vehicles is increased.

- The Act disallows a deduction for an activity generally considered to be entertainment, amusement, or recreation as well as membership dues for any club organized for business, pleasure, recreation, or other social purposes. Businesses can still generally deduct 50% of the cost of qualified business meals.

PAID FAMILY LEAVE

August 1, 2017

On April 4, 2016, Governor Cuomo signed into law a new Paid Family Leave policy. Starting January 1, 2018, ALL private employers will be required to offer their full- and part-time employees job-protected, paid leave that can be used to care for a new child, care for a loved one, including a child, grandchild, spouse, domestic partner, parent, or grandparent with a serious health condition, or to help relieve family pressures when someone is called to active military service. Employees are guaranteed the right to return to their jobs and continue their health insurance.

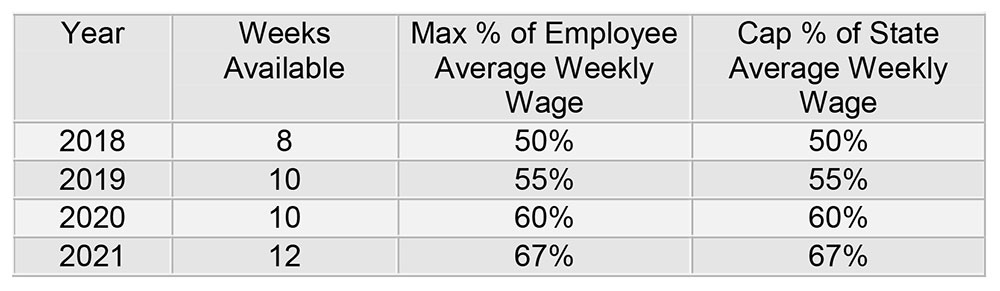

Paid Family Leave will phase in over the next 4 years with gradually increasing benefits:

Employees may take the maximum benefit length in any given 52-week period. The 52-week clock starts on the first day the employee takes Paid Family Leave.

Paid Family Leave coverage will be included under the disability policy all employers must carry. The premium will be funded solely by employees through payroll deductions. Beginning January 1, 2018, the maximum employee contribution rate will be set at 0.126% of an employee’s wage up to and not to exceed the statewide average weekly wage (currently $1,305.92). A maximum employees’ contribution rate will be established each year. Participation in the program is not optional for employees.

Employees who work a regular schedule of 20 or more hours per week are eligible after 26 weeks of employment. Employees who work a regular schedule of less than 20 hours per week are eligible after 175 days worked.

For more information, please contact your disability insurance provider or call our office at (716) 634-1100.

IRS SCAMS

July 17, 2017

The IRS is reminding taxpayers to remain alert to aggressive and threatening phone calls by criminals impersonating IRS agents using fake names and bogus IRS identification badge numbers. These scammers may possess information pertinent to their targets, and they usually alter the caller ID to make it appear as though the IRS is calling.

The IRS has issued warnings regarding the following scams:

A scam linked to the Electronic Federal Tax Payment System (EFTPS) has been reported nationwide. The caller claims to be from the IRS and says that two certified letters mailed to the taxpayer were returned as undeliverable. The scammer threatens arrest if a payment is not made immediately via a specific prepaid debit card they claim is linked to the EFTPS, but is actually controlled by the scammer. Victims are warned not to talk to their tax preparer, attorney or the local IRS office until after the payment is made.

The IRS does not make “robo-calls” leaving prerecorded, urgent messages asking for a call back. In this tactic, scammers tell victims that if they do not call back, a warrant will be issued for their arrest. Those who do respond are told they must make immediate payment either by a specific prepaid debit card or by wire transfer.

The IRS recently began sending letters to a relatively small group of taxpayers whose overdue federal tax accounts are being assigned to one of four private-sector collection agencies. The IRS-authorized firms will only be calling about a tax debt the person has been aware of for years. The IRS would have previously contacted taxpayers about their tax debt.

According to their website, the IRS and its authorized private collection agencies will never:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. The IRS does not use these methods for tax payments. Generally, the IRS will first mail a bill to any taxpayer who owes taxes. All tax payments should only be made payable to the U.S. Treasury and checks should never be made payable to third parties.

- Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying.

- Demand that taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed.

- Ask for credit or debit card numbers over the phone.

*IF YOU OR A LOVED ONE HAS RECEIVED THIS TYPE OF PHONE CALL, PLEASE CONTACT OUR OFFICE IMMEDIATELY TO HELP YOU.

NEW DUE DATES FOR CERTAIN TAX RETURNS

January 3, 2017

Below is a list of the new federal and New York due dates generally applicable for 2016 tax returns (2017 filing season).

March 15 (Extensions Until Sept. 15)

- Form 1065, U.S. Return of Partnership Income; and

- Form 1120S, U.S. Income Tax Return for an S Corporation.

Note: This is the due date for the tax return and also for the Schedules K-1 that the entity must provide to its owners.

April 15 (Extensions Until Oct. 15, Unless Noted Below)

- Form 1040, U.S. Individual Income Tax Return;

- Form 1041, U.S. Income Tax Return for Estates and Trusts (extensions until Sept. 30);

- Form 1120, U.S. Corporation Income Tax Return (extensions until Sept. 15)

- FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR)

May 15 (Extensions Until Nov. 15)

- Form 990, Return of Organization Exempt From Income Tax

July 31 (Extensions Until Oct. 15)

- Form 5500 for employee benefit plans.

INCREASED MINIMUM WAGE AND SALARY REQUIREMENTS

December 31, 2016

As of 12/31/2016, the basic minimum wage increased to $9.70 per hour and the fast food minimum wage increased to $10.75 per hour in most of New York State.

As of 12/31/2016, the minimum salary for exempt executive and administrative employees in upstate New York increased to $727.50 per week ($37,830 annually).

There are different minimum wage rates for Long Island, Westchester County, and large and small employers in New York City.

The nationwide preliminary injunction blocking the new overtime rules that would increase the minimum salary for exempt employees to $913 per week (described below) is still in effect.

Preliminary Injunction

November 23, 2016

Yesterday a Federal Judge in Texas issued a nationwide preliminary injunction blocking the new overtime rules scheduled to take effect on December 1. These rules would have increased the minimum salary for most exempt employees to $47,476.

The decision indicates that it is likely the Judge will ultimately issue a permanent injunction.

It remains to be seen whether the Trump administration would appeal this action.

We will keep you informed as to all further developments.

New Overtime Rules

The Fair Labor Standards Act (FLSA) requires that employers pay eligible non-exempt employees an overtime premium of at least 1.5 times their regular rate of pay for hours worked over 40 in a work week. Now, the U.S. Department of Labor (DOL) has extended overtime protections to far more employees by approving a revision to the federal overtime regulations, and an increase to the salary threshold for the executive, administrative, and professional white-collar exemptions from the overtime provisions.

Effective December 1, 2016, the weekly salary threshold doubles from $455 ($23,660 annually) to $913 ($47,476 annually), for the executive, administrative, and professional white-collar exemptions under the FLSA.

Certain types of businesses that tend to have a significant number of exempt managers who currently make more than $23,660 annually, but less than $47,476 annually — such as restaurants, daycare facilities, manufacturers, and retailers — could be affected most by the rule. Due to this new rule, businesses may face increasing payroll costs and the potential for expanded recordkeeping requirements for certain employees. Please contact us so that we can help you address these rules.

Welcome New Partner

Bronsky & Company is pleased to announce that David K. Hanley, CPA, CFE, MBA has joined the Firm as a partner with an expertise in merger and acquisition and asset based lending due diligence, forensic accounting services, business interruption insurance claim services, and profitability analysis. He has experience in various industries including, but not limited to, manufacturing, technology, telecommunications, natural resources and metals, distribution, retail, and healthcare.

Announcing A New Strategic Alliance

Bronsky & Company announces that it has entered into a strategic alliance with Michael Brummer & Associates Consulting (MBA). The ability to integrate the long-standing, successful turnaround consulting of MBA with Bronsky & Company’s proven track record of excellence in auditing and field examinations will provide the marketplace with a combination of skills and experience that is expert as well as highly efficient!